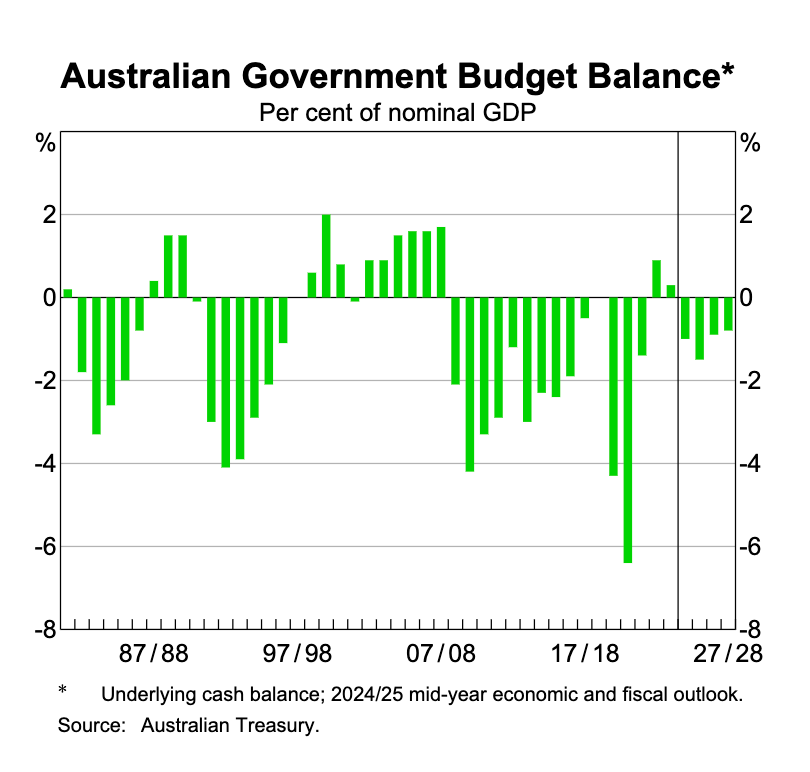

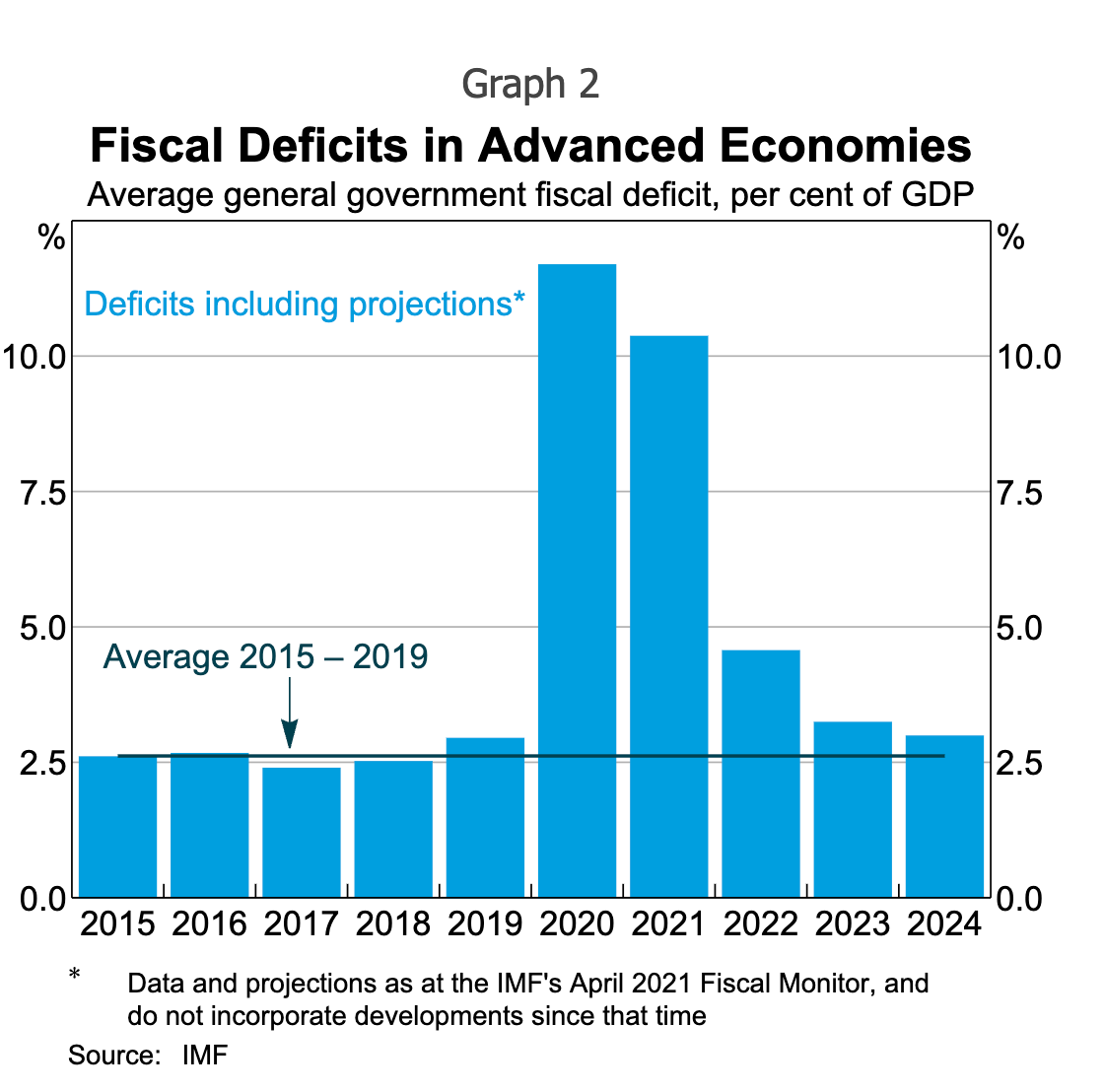

In the last 16 years, the Australian government has maintained a budget deficit in 15 of them. Australia is not alone in this trend, as both the United States and Japan have had negative budgetary outcomes every year since 2000. Whilst this is par for the course during times as volatile as the past decade and a half has been, the sheer consistency of global budgets deficits over this time period seems alarming from a Keynesian perspective.

Government debt is an exceeding issue for many nations, with the USA spending 2.4% of GDP on interest repayments on their US$35.2t of federal debt. Although this much debt should be an issue for the solvency of federal governments (global public debt was at 92% of GWP in 2023), it has had a varied impact on the confidence in governments’ abilities to meet their obligations. The exchange rate of a nation’s currency (according to its trade weight index) is a key indicator of investor confidence in its ability to pay for its debt. The difference between the USD’s appreciation of 4.15%, with Japanese Yen Currency Index’s depreciation -23.36% over the last five years highlights how the respective third and first most deeply indebted G20 nations as percentage of GDP have been impacted differently by their large liabilities. This is illustrated by the United States’ large federal debt seemingly has little impact on investor and public stability sentiment.

In addition, the financing of these deficits may raise some eyebrows, as monetary funding (the use of central bank created reserves to finance spending) continues to grow in popularity. In 2020 and 2021, the RBA’s purchasing of Australian government securities using their general reserves largely matched the figures of the budget deficits, although the central bank argued that the purpose was to decrease long term interest yields (quantitative easing).

The current level of government over-expenditure seems to carry a risk to international and price stability; however, those impacts are yet to rear their head. The real GDP of the G20 since the COVID19 pandemic has grown at significant rates, largely off the back of fiscal stimulation, detailing the significant benefits of the budgetary status quo.

The major question this spurs most to ask is, ‘where is this money and growth coming from?’, but from a more political point of view, I tend towards questioning the dissonance between public wants and government actions. Every election cycle I see and hear calls for budget balancing, yet the elected Australia government has not targeted fiscal consolidation since the GFC due to the seemingly endless benefits of spending beyond their revenue. Why is it that the world’s premiere economists, policy makers and analysts have all but adopted modern monetary theory and budgetary expansionism within their fiscal response, to largely effective results, but the layman still votes for fiscal conservatism?

Anecdotally, I tend to believe that the general public, those without a keen interest in economics, tend to have a distorted view of what effective government spending truly is. For the vast majority, the term budget brings to mind their own personal finances, where a deficit is their worst nightmare, not a necessary position for the welfare of a nation. There is also a tendency to conflate the operations of a government with those of a private organisation, simplifying the economic role of the government to that of remaining operational, rather than considering the immense nuances of an effective government as a rather important third economic actor.

Although these misconceptions may seem small, they pose immense implications for the economic future of nations across the world. In the case where current government spending is actually the most effective form of policy in the long term, the demand for fiscal balancing may lead to tradeoffs in as voters may elect a more fiscally conservative party, harming both economic growth and social outcomes simultaneously. However, the thoughts and ideas of the world’s premiere economists should not always be taken as gospel, as the 2008 Global Financial Crisis shows. In such a case, the commonsense approach of the everyman may prove to be the voice of reason in an increasingly riskier economy.

Will voters stop the borrowing before it gets to a breaking point? Will we see a debt crisis on a scale far worse than that of Europe in the 2010s? Or does this spending simply signal an unprecedented change to the way governments conduct fiscal policy, ushering in a new era of economic prosperity? The one certain thing in this scenario is that we do not know how long this trend will continue, and that we will have to wait and watch to see the ultimate outcome.