The global financial crisis of 2008 was a period of extreme stress in financial markets and banking systems worldwide. After a downturn in the United States housing market, the crisis quickly spread around the world. Although more prominent factors existed, investors contributed to this crisis by aggressively seeking high returns. Since 2008, there have been several other global crises. This article will explore popular investor psychological strategies and their impacts during a crisis.

[Navya is a high school student in the United States interested in aspects of real estate economics and finance. As a young scholar, she brings fresh perspectives to the world of business and looks forward to sharing her insights with a wider audience.]

Economic background

A financial crisis is caused by systemic failures and uncontrollable human behaviour. More specifically, the 2008 crisis was triggered by banks’ risky approaches, leading to a market collapse when those risks failed (Turner, 2023). Financial crises cause panic among investors due to the financial sector’s fragility. Oftentimes, it struggles to balance keeping money safe when making long-term loans (Ben S. Bernanke, Timothy F. Geithner, Henry M. Paulson Jr., 2020). When investors panic during a financial crisis, it can shake the entire market. Central banks help manage these situations by changing interest rates to stabilise the economy.

When they lower the interest rates, it becomes cheaper to borrow money, encouraging consumption and investment. Both individuals and businesses are more likely to take out loans for significant purchases or investments. The increased spending stimulates demand for goods and services, hence higher production levels and in some cases, more job creation. Consequently, this contributes to overall economic growth. By contrast, when interest rates are raised, it becomes more expensive to borrow money, slowing expenditure, consumption, and investment. This can help slow the rate of inflation, which is the general increase of prices over time.

The Most common psychological dynamics of investing

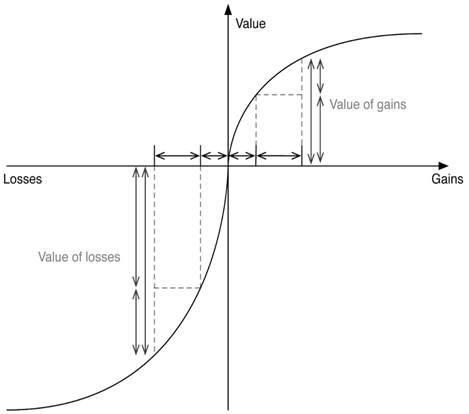

When it comes to investing, there are specific psychological dynamics that impact behaviours. Two of the most common are loss aversion and overconfidence.

Loss aversion is when individuals tend to prefer avoiding losses rather than acquiring equivalent gains, this is a major reason why so many investors underperform in the market. The year 2022 saw a crisis somewhat kindred to 2008. According to the financial research company DALBAR, the average equity investor lost 21.7%, while the 500 largest corporations in the US lost 18.1%. This direct gap shows that an individual investor performed worse than the broader market, which may be characteristic of investors simply selling their stocks out of fear (Aguilar, 2023). Overall, loss aversion leads investors to sell assets quickly during a crisis to avoid further losses.

In the same vein of cognitive biases, overconfidence is where individuals overestimate their abilities, leading to errors in success. Many investors are not aware of their overconfidence and tend to believe they can predict market movements. According to published research, overconfidence is a large part of excessive and asymmetric volatility in the global markets. Namely, this bias caused aggressive unequal trading volumes where investors traded excessively believing they were well aware of the market’s circumstances but instead increased stock price fluctuation during the 2008 crisis and exacerbated the financial market (Jlassi, Mansour, Naoui, 2013).

Similar to loss aversion, prospect theory is a concept that suggests that people are more inclined to take a more risk-averse approach to situations to favour more certain outcomes. In the chaos of a financial crisis, investors often make decisions based on options with the highest assurance of gains, rather than on calculated analyses. When faced with a choice between a guaranteed loss of $250 and a gamble to either lose $0 or $500 with a 50-50 chance, people typically choose the gamble. Though both options have the same expected value, this preference arises because, within the first option, there is a guaranteed loss and humans tend to avoid a guaranteed loss, which is perceived as the ultimate goal.

Interestingly, the inverse is true when it comes to potential gains. If there is a guarantee to win $500 and an equal chance to either get none or $1000, people tend to pick the guaranteed $500. This can lead to decisions that might seem irrational under normal market conditions but are driven by the perceived immediate outcomes during a crisis.

Strategies

To avoid possible missteps in catastrophes, investors can consider consulting an advisor. Advisors can provide a buffer against panic-driven decisions by educating investors about how the market moves over time. Another way is to consider conducting a “premortem” analysis, a technique promoted by Daniel Kahneman, where investors envision their investment strategy’s success and failure from a future perspective. It involves imagining that the investment strategy you want to conduct has succeeded, and thinking of all the reasons for its success and vice versa for its failure (Aguilar, 2023). This can show potential risks that people may overlook when faced with uncertainty. By using these strategies and recognizing the psychological factors at play, investors can better navigate during a financial crisis and achieve greater financial stability.

References

Aguilar, O. (2023, October 25). Loss aversion bias. Schwab Brokerage. https://www.schwabassetmanagement.com/content/loss-aversion-bias

Aguilar, O. (2023, October 25). Overconfidence bias. Schwab Brokerage. https://www.schwabassetmanagement.com/content/overconfidence-bias

ascendgrp, P. author By. (2020, January 23). How psychology impacts investing. ASCEND GROUP AGRP. https://www.ascendgrp.com/how-psychology-impacts-investing/

Bernanke, B. S., Geithner, T. F., & Paulson Jr., H. M. (2020, February 12). Fear and financial crisis. Fear and Financial Crisis. https://yalebooks.yale.edu/2020/02/12/fear-and-financial-crisis/

Jlassi, M., Naoui, K., & Mansour, W. (2014, December 4). Overconfidence behavior and Dynamic Market Volatility: Evidence from International Data. Procedia Economics and Finance. https://www.sciencedirect.com/science/article/pii/S2212567114004353

Turner, J. (2023b, September 4). Why did the global financial crisis of 2007-09 happen?. Economics Observatory. https://www.economicsobservatory.com/why-did-the-global-financial-crisis-of-2007-09-happen

Toxboe, A. (n.d.). Loss aversion design pattern. UI Patterns. https://ui-patterns.com/patterns/Loss-aversion